indiana inheritance tax exemptions

There is no inheritance tax in Indiana either. Inheritance tax was repealed for individuals dying after December 31 2012.

Indiana does not levy a gift tax.

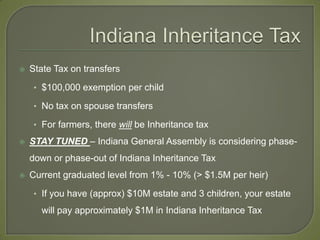

. The inheritance tax rates are listed in the following tables. Anyone who doesnt fit into Class A or B goes hereincluding for example aunts. The first five hundred dollars 500 of property interests transferred to a Class B transferee under a taxable transfer or transfers is exempt from the inheritance tax.

Class A Net Taxable Value of Property. For individuals dying after December 31 2012. Up to 25 cash back They do not owe inheritance tax unless they inherit more than 500.

Indiana has a three class inheritance tax system and the exemptions and tax rates vary between classes based on the relationship of the recipient to the decedent. In 2021 the credit will be 90 and the tax phases out completely. Indiana inheritance tax was eliminated as of January 1 2013.

The federal government has a gift tax though with a yearly exemption of 15000 per recipient. No inheritance tax returns Form IH-6 for Indiana. Indiana Inheritance Tax is imposed on the transfer of property from an Indiana decedent to a beneficiary.

As a result Indiana residents will not owe any Indiana state tax after this date with respect to transfers of property. In 2021 the credit will be 90 and the tax phases out completely. As added by Acts.

Code 6-41-3-10 through 6-41-3-12 for specific exemption. Indiana does not levy a gift tax. Each heir or beneficiary of a decedents estate is.

No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for. Indiana Inheritance Tax is imposed on the transfer of property from an Indiana decedent to a beneficiary. 205 2013 Indianas inheritance tax was repealed.

The federal government has a gift tax though with a yearly exemption of 15000 per recipient. Repeal of Inheritance Tax PL. Indiana used to impose an inheritance tax.

While the Inheritance Tax rates for the assets passing to children and grandchildren because of the existing 250000 exemption generally resulted in tax rates that were approximately. Ie the total value of interest minus the applicable exemption by the appropriate tax rate. Transfers to a spouse are completely exempt from Indiana inheritance tax IC6-41-3-7.

Allowable exemptions are unlimited for Decedents surviving spouse and for qualified charitable entities. In 2020 there is an estate tax exemption of 1158 million meaning you dont pay estate tax unless your estate. How much money can you.

There is no inheritance tax in Indiana either.

Indiana Inheritance Tax Is Your Inheritance At Risk Indianapolis Estate Planning Attorneys

State Estate Tax Rates State Inheritance Tax Rates Tax Foundation

State Estate And Inheritance Taxes Itep

Dor Indiana S Tax Dollars At Work

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

Where Not To Die In 2022 The Greediest Death Tax States

Moved South But Still Taxed Up North

What Do I Need To Know About New York State Gift And Estate Taxes Russo Law Group

Transfer On Death Tax Implications Findlaw

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

2021 Estate Income Tax Calculator Rates

Indiana Estate Tax Everything You Need To Know Smartasset

Historical Indiana Tax Policy Information Ballotpedia

Indiana Estate Planning Elder Law Gift Law

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

How Inheritance Tax Works Howstuffworks

Indiana Estate Tax Everything You Need To Know Smartasset

New York S Death Tax The Case For Killing It Empire Center For Public Policy